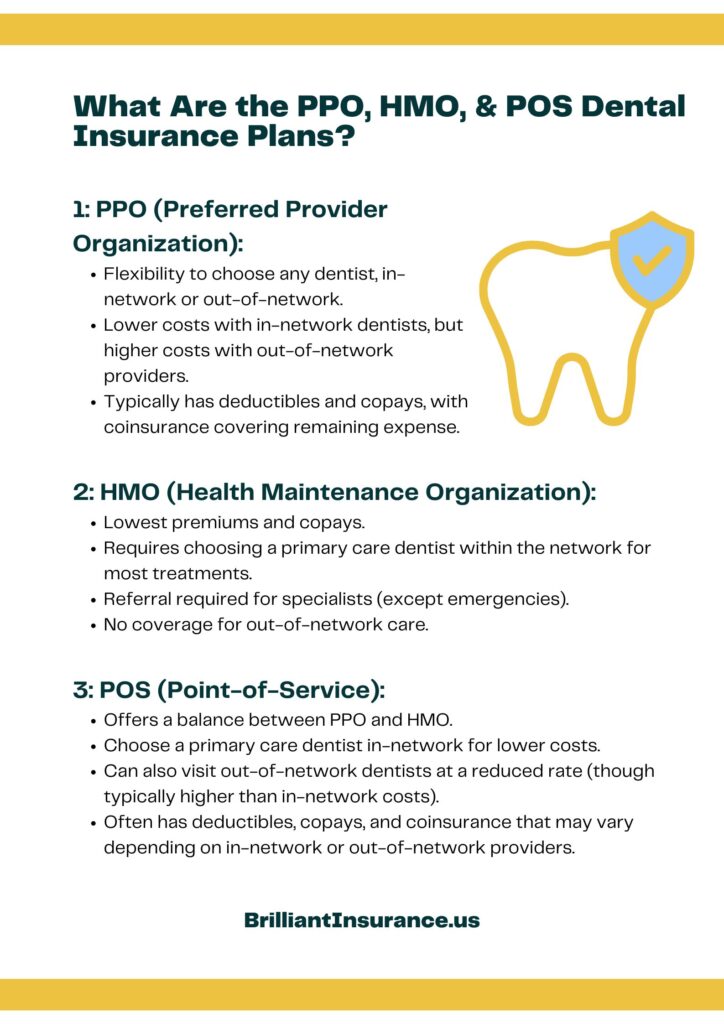

Dental insurance plans come in different sizes, provider options, costs, and coverage. The three common types of dental insurance plans are PPO, HMO, and POS. PPO refers to the preferred provider organization, HMO to the health maintenance organization, and POS to the point of service. Each plan has its own pros and cons, depending on your dental needs and preferences. This blog post will compare the main features and differences of PPO, HMO, and POS plans and provide guidance on how to choose the best dental insurance plan for your situation and budget.

what is PPO dental insurance Plans?

PPO stands for preferred provider organization, which is a type of dental insurance plan that allows you to choose any dentist you want, regardless of their network affiliation. However, you will save money if you visit an in-network dentist, as they have negotiated lower fees with the plan. A PPO plan usually has a deductible, which is the amount you pay before the plan covers any costs. It also has a copay, which is the fixed amount you pay per visit, and a coinsurance, which is the percentage of the cost you split with the plan after meeting the deductible. A PPO plan also has an out-of-pocket maximum, which caps the amount you pay in a year. Once you reach this limit, the plan pays for all the covered services.

Benefits

• You have more flexibility and control over your dental care and provider choices.

• You can access specialist care without needing a referral from your primary care dentist.

• You have some coverage for out-of-network care, although at a reduced rate.

Drawbacks

• You pay higher premiums, deductibles, and coinsurance than other plans.

• You must submit claims for out-of-network care, which can be tedious and complex.

• You may have to pay the balance between the plan’s allowed amount and the dentist’s actual charge, which can be substantial.

What is HMO Dental Insurance Plans?

HMO stands for health maintenance organization, which is a type of dental insurance coverage that assigns you a primary care dentist from a network of providers. Your primary care dentist will handle most of your dental needs and refer you to a specialist if necessary. You will only receive coverage for in-network care, except for emergencies. An HMO plan usually has a low or no deductible and a low or no copay. It does not have a coinsurance or an out-of-pocket maximum.

Benefits

• You pay lower premiums, deductibles, and copays than other plans.

• You do not have to submit claims, as the plan pays the dentist directly.

• You do not have to pay the balance between the plan’s allowed amount and the dentist’s actual charge, as they are the same.

Drawbacks

• You have limited choice and flexibility in selecting your dentist and changing dentists.

• You have to obtain a referral from your primary care dentist to access specialist care, which can be inconvenient and delay your treatment.

• You have no coverage for out-of-network care, which can be expensive if you need it.

What is POS Dental Insurance Plans?

Point of Service (POS) is a type of dental insurance policy that provides a balanced approach between PPO and HMO plans. In a POS plan, you are required to choose a primary care dentist from a network of providers. However, you are also allowed to visit out-of-network dentists at a reduced rate. A POS plan usually includes a deductible, a copay, and a coinsurance, but the amounts may differ depending on whether you receive in-network or out-of-network care. Additionally, a POS plan has an out-of-pocket maximum, which varies depending on the type of care you receive.

Benefits

• You get more options and flexibility than an HMO plan, but at the same time, enjoy more savings than a PPO plan.

• You have the freedom to choose between in-network dentists for reduced costs or out-of-network dentists for greater convenience.

• You can access specialist care without a referral from your primary care dentist, as long as they are in-network.

Drawbacks

• You will have to bear higher premiums, deductibles, and coinsurance compared to an HMO plan, but lower than a PPO plan.

• You will need to submit claims for out-of-network care, which may be a tedious and complex process.

• You may have to pay the balance between the plan’s allowed amount and the dentist’s actual charge, which in some cases, can be a considerable amount.

PPO vs. POS Plans: What’s the Difference?

- Flexibility vs. Cost: PPO plans offer more freedom. You can see any doctor (in-network or out) without a referral, but out-of-network care is expensive. POS plans require an in-network PCP for referrals (except for some specialists like OB-GYNs). They typically have lower premiums but may have deductibles for in-network care.

- Cost Breakdown: PPOs tend to have higher premiums but lower copays and coinsurance for in-network care. POS plans often have lower premiums but might require meeting a deductible before coverage kicks in, even in-network.

Choose PPO if: You prioritize flexibility and are willing to pay more for it.

Choose POS if: You want a balance between affordability and some choice in doctors.

DPPO vs. DHMO Plans: What Are the Difference?

- Focus on Cost vs. Network: DHMO plans are the most budget-friendly option. They require a primary dentist and limit care to in-network providers. Out-of-network coverage is rare. DPPO plans offer more flexibility with a wider network of dentists. You can see any dentist (in-network or out), but out-of-network care comes with higher costs.

- Predictable Costs vs. Potential Savings: DHMO plans typically have no deductibles and low copays for in-network services, making costs predictable. DPPO plans often have deductibles and higher copays for out-of-network care, but in-network costs can be lower than DHMO plans.

Choose DHMO if: You prioritize affordability and are comfortable with a limited dentist network.

Choose DPPO if: You value choice in dentists and are willing to pay more for it.

Is PPO or HMO Better for Dental?

There’s no single “better” option. It depends on your priorities:

- Cost: HMOs are generally cheaper due to limited networks and predictable costs.

- Flexibility: PPOs offer more freedom to choose any dentist (in-network or out).

- Frequency of Visits: If you need frequent dental care, predictable costs of an HMO might be ideal.

- Dental Needs: If you have complex dental needs, a PPO could be better to access specialists outside the network.

Consider your budget and dental needs. Talk to your dentist about participating plans to see which best suits you.

Comparison Table

Here is a summary table that compares the key features and costs of PPO, HMO, and POS plans:

| Feature/Cost | PPO Plan | HMO Plan | POS Plan |

| Network Size | Large (extensive network of dentists) | Small (limited network of dentists) | Medium (moderate network of dentists) |

| Provider Choice | Any dentist within the network | Primary care dentist within the network | Primary care dentists within the network or out-of-network dentists at a higher cost |

| Referral Requirement | No | Yes, referrals from primary care dentists are required for specialists | No for in-network providers, yes for out-of-network providers |

| Premium | High (due to large network and flexible provider choice) | Low (due to smaller network and referral requirements) | Medium (due to moderate network size and flexible provider options) |

| Deductible | High (portion of covered expenses paid by the insured before insurance kicks in) | Low or no deductible (lower out-of-pocket costs upfront) | Varies depending on the plan |

| Copay | Low or no copay (fixed amount paid by the insured for each covered service) | Low or no copay (predictable out-of-pocket expenses) | Varies depending on the plan |

Conclusion

Choosing the best dental insurance plan for yourself can be a challenging task, as it depends on several factors such as your dental health, preferred dentist, frequency of visits and expected treatments. You should compare the costs and features of various plans and select the one that fits your budget and requirements the most. If you need any further information or assistance, please don’t hesitate to contact us. We are always here to help you find the best dental insurance plan that suits your needs. You can also get a quote from us to see how much you can save with our affordable and quality dental insurance plans.