The insurance industry, traditionally known for its conservative approach, is undergoing a significant transformation, thanks to Artificial Intelligence (AI). AI is not just a buzzword in this sector; it’s a game-changer, reshaping how insurance companies operate, interact with customers, and manage risks. This blog delves into the various facets of this transformation, underpinned by compelling statistics that highlight AI’s profound impact on the insurance landscape.

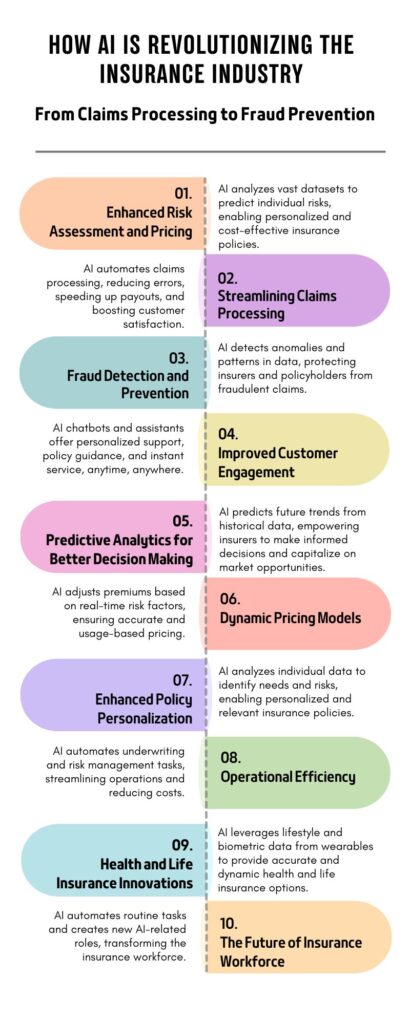

AI can add value to the Insurance industry in following ways –

1. Enhanced Risk Assessment and Pricing

One of AI’s most significant contributions to insurance is in risk assessment and pricing. By analyzing vast datasets, AI algorithms can predict risks with greater accuracy. This precision in risk assessment allows for more personalized insurance policies. Rather than using a one-size-fits-all approach, insurers can offer premiums based on individual risk profiles, which is fairer for consumers and more profitable for insurers.

2. Streamlining Claims Processing

AI is dramatically streamlining claims processing, an area traditionally bogged down by manual processes and paperwork. As per McKinsey & Company report, AI-enabled claims management can reduce claims-processing time by up to 70% and lower the cost of claims handling by 30%.

This efficiency is primarily due to automation and the ability of AI to analyze, and process claims data quickly. This not only speeds up the settlement process but also reduces the likelihood of errors, leading to higher customer satisfaction.

3. Fraud Detection and Prevention

Insurance fraud is a significant challenge in the industry, leading to losses amounting to billions annually. AI, with its advanced analytics and pattern recognition capabilities, is becoming a vital tool in combating this issue. AI algorithms can detect anomalies and suspicious patterns that might be indicative of fraudulent activity, thereby protecting both the insurer and honest policyholders.

4. Improved Customer Engagement

The advent of AI-powered chatbots and virtual assistants has transformed customer service in the insurance industry. These AI tools provide 24/7 support, answering queries, offering policy recommendations, and even guiding customers through the claims process. These AI interfaces are not only more efficient but also offer a personalized experience, increasing customer engagement and satisfaction.

5. Predictive Analytics for Better Decision Making

Predictive analytics, a crucial aspect of AI, enables insurers to make better-informed decisions. By analyzing past data, AI can forecast future trends, helping insurers in areas like customer churn prediction, demand forecasting, and even identifying new market opportunities.

6. Dynamic Pricing Models

Dynamic pricing is another area where AI is making a significant impact. By continuously analyzing real-time data, AI enables insurers to adjust premiums based on current risk factors. For instance, in auto insurance, telematics data can be used to adjust premiums based on driving behavior. This approach benefits both insurers and customers by providing more accurate, usage-based pricing.

7. Enhanced Policy Personalization

AI’s ability to process and analyze vast amounts of data allows for unprecedented levels of policy personalization. Insurers can now offer policies tailored to the specific needs and risk profiles of individuals.

8. Operational Efficiency

AI is not only transforming customer-facing aspects of insurance but also enhancing operational efficiency. From automated underwriting to AI-driven risk management, the operational improvements are significant.

9. Health and Life Insurance Innovations

In health and life insurance, AI is enabling new forms of underwriting based on lifestyle and biometric data. Wearable technology, for instance, provides real-time health data that can be used for more accurate underwriting and dynamic pricing.

10. The Future of Insurance Workforce

AI is reshaping the insurance workforce, automating routine tasks and creating new roles focused on AI management and data analysis. This evolution represents a significant shift in the industry’s employment landscape.

FAQs

1. How will AI affect the role of insurance agents and brokers in the future?

AI won’t replace insurance agents but shift their focus. Repetitive tasks like quote generation and claims processing will be automated, freeing agents for complex roles like risk assessment, personalized advice, and building trust with clients. Brokers can leverage AI for market analysis and product customization, becoming more strategic advisors.

2. Can AI completely eliminate fraud in the insurance industry?

No, while AI can significantly reduce fraud through anomaly detection and pattern recognition, human expertise remains crucial for complex cases and preventing sophisticated schemes. Complete eradication is unlikely, but AI can be a powerful ally in the fight against fraud.

3. What are the biggest advantages and disadvantages of using AI in the insurance industry?

Advantages: Faster, cheaper claims processing, personalized premiums, fraud detection, and improved customer service.

Disadvantages: Data privacy concerns, ethical considerations around bias and fairness, job displacement, and reliance on complex technology.