Accidents are an unwelcome reality of life, and being financially prepared for unexpected injuries is a proactive step towards safeguarding your well-being. Accident insurance, as a supplemental insurance policy, steps in to provide cash benefits that help cover out-of-pocket costs associated with qualifying injuries. In this comprehensive guide, we’ll explore the common injuries covered by accident insurance, shedding light on the key aspects of this valuable protection.

What is Accident Insurance?

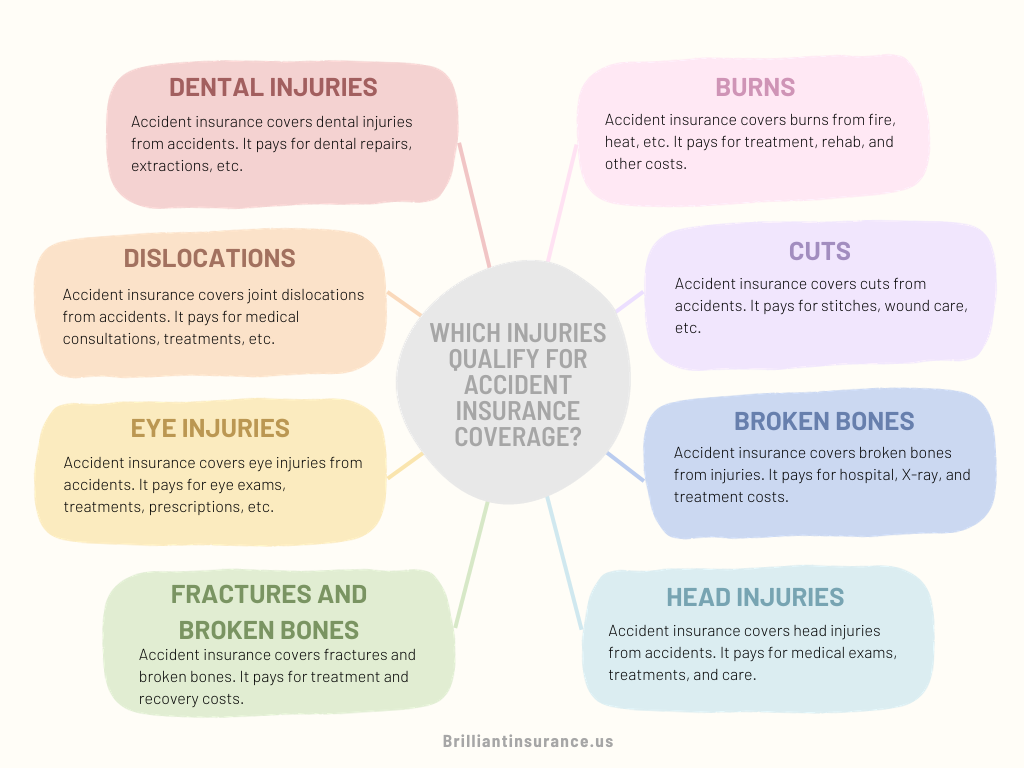

Accident insurance is designed to offer financial support when you experience a qualifying injury. The specific injuries covered can vary by policy, but there are common categories that are typically included in most plans. Let’s delve into the injuries that accident insurance commonly covers:

1. Burns

Accidental burns, whether caused by fire, hot surfaces, or other unforeseen incidents, are generally covered by accident insurance. This coverage ensures that you receive financial assistance for medical treatments, rehabilitation, and associated expenses.

2. Cuts

Accidents resulting in cuts and lacerations can happen unexpectedly. Accident insurance provides coverage for the medical costs related to stitches, wound care, and any other necessary treatments.

3. Broken Bones

Fractures and broken bones are prevalent injuries that accident insurance addresses. The coverage includes expenses related to hospital visits, X-rays, and treatments needed for a speedy recovery.

4. Head Injuries

Accidental head injuries leading to concussions, whiplash, and other head injuries fall under the purview of accident insurance. This coverage helps ease the financial burden associated with medical evaluations, treatments, and any necessary follow-up care.

5. Dental Injuries

Accident insurance recognizes the significance of dental injuries, offering coverage for treatments related to accidental damage to teeth. This can include procedures like dental repairs or extractions necessitated by an injury.

6. Dislocations

Joint dislocations resulting from accidents are typically covered by accident insurance. The policy ensures that the associated medical costs, including consultations and treatments, are taken care of.

7. Eye Injuries

Accidental eye injuries, whether caused by foreign objects, impact, or other unforeseen events, are commonly covered by accident insurance. This coverage extends to medical expenses related to eye examinations, treatments, and prescriptions.

8. Fractures and Broken Bones

Injuries involving fractures and broken bones, irrespective of the location on the body, are within the coverage scope of accident insurance. The policy helps alleviate the financial strain of medical treatments and recovery.

Additional Coverage Options for Accident Insurance Policyholders

Moreover, certain policies offer comprehensive coverage that extends beyond the core benefits. These additional features cater to specific scenarios, enhancing the overall protection provided by accident insurance. Here are some detailed aspects that may be covered by specialized policies:

- Loss of Limb or Function: Specialized accident insurance plans address permanent disability resulting from accidents, providing coverage for loss of limb or function. Policyholders may receive lump-sum payments or income replacement, offering crucial financial support during challenging transitions.

- Hospitalization and Medical Expenses: Some accident insurance policies offer comprehensive protection for hospitalization and medical expenses beyond basic coverage. This includes surgeries, specialized treatments, and other necessary medical interventions crucial for a full recovery.

- Ambulance Services: Quick and efficient transportation to a medical facility is critical after an accident. Specialized accident insurance plans can cover ambulance services, ensuring that the costs of medically necessary transportation are taken care of, easing an additional financial burden.

- Rehabilitation and Therapy: Recognizing the need for extensive recovery, specialized accident insurance policies include coverage for rehabilitation and therapy. This encompasses physical therapy and necessary rehabilitation expenses, supporting individuals in achieving a more comprehensive recovery.

What are the Exclusions for Personal Accident Insurance?

It’s crucial to be aware that, despite the broad coverage offered by accident insurance, certain injuries or scenarios may be excluded from coverage. Understanding these exclusions is essential for making informed decisions about your insurance needs. Some exclusions to be mindful of include:

- Intentional Injuries: Accidents arising from intentional self-inflicted harm or attempted criminal activities are typically excluded from coverage. Insurance policies are designed to provide financial protection for unforeseen events, and intentional actions may fall outside the scope of coverage.

- Pre-existing Conditions: Injuries related to pre-existing conditions might not be covered, or coverage may be partial, depending on the policy terms. It’s crucial to carefully review policy details to understand the extent of coverage in such cases.

- War or Terrorism: Injuries resulting from war, acts of terrorism, or other intentional acts of violence are usually excluded from standard accident insurance coverage. These scenarios often fall under separate insurance categories due to their distinct nature.

- Participation in High-Risk Activities: Some policies may exclude injuries sustained while participating in high-risk activities such as extreme sports or skydiving. Individuals engaged in such activities may need to explore specialized insurance options that cater to these specific risks.

Given the intricacies and variations in accident insurance policies, it’s paramount to adopt a proactive approach when navigating through the details. Here are essential considerations to ensure that you make informed choices regarding your accident insurance coverage:

- Thoroughly Read Your Policy: Carefully review your accident insurance policy to understand the specific details of coverage, including any limitations, exclusions, or additional features. This knowledge forms the foundation for making informed decisions about your insurance needs.

- Consult with Your Accidental Insurance Provider: Insurance providers are valuable resources for clarifying any uncertainties or queries related to your policy. Don’t hesitate to reach out to your insurance provider for detailed explanations or additional information about the coverage offered.

- Evaluate Your Individual Needs: Each individual’s lifestyle and potential risks are unique. When selecting an accident insurance policy, consider your specific needs and potential exposures. Choose a policy that provides adequate coverage for your lifestyle, ensuring that you are protected in various scenarios.

Conclusion

Accident insurance acts as a vital safety net, offering financial assistance for various qualifying injuries. Whether it’s burns, cuts, dental issues, or fractures, accident insurance helps offset the out-of-pocket expenses linked to unforeseen accidents. To make informed decisions and ensure comprehensive protection, it’s essential to grasp the coverage provided by accident insurance. By gaining a thorough understanding of the policy details and staying updated on its specifics, you can confidently navigate the insurance landscape. This approach ensures that your chosen policy aligns with your unique needs, providing the protection you’re looking for.