Life’s unpredictability necessitates safeguarding ourselves and those dear to us against unforeseen financial burdens. In the event of the policyholder’s death, the beneficiaries of their life insurance are entitled to a death benefit – a crucial financial provision made by the insurer to support them during challenging times.

Navigating the process of claiming life insurance benefits can be a complex journey. In this blog post, we simplify the steps involved in claiming life insurance, providing a clear guide for policyholders and beneficiaries. From gathering necessary documents to understanding payout options, we break down the process, offering insights and tips to ensure a smooth and informed experience during what can be an emotionally challenging time. Join us as we shed light on the key aspects of claiming life insurance, making it more accessible for those seeking financial security and peace of mind.

What is the Process to Claim Life Insurance?

Facing the need to claim life insurance benefits can be a challenging time, but understanding the process and being prepared can make it smoother. In this comprehensive guide, we’ll walk you through the essential steps to successfully claim life insurance benefits.

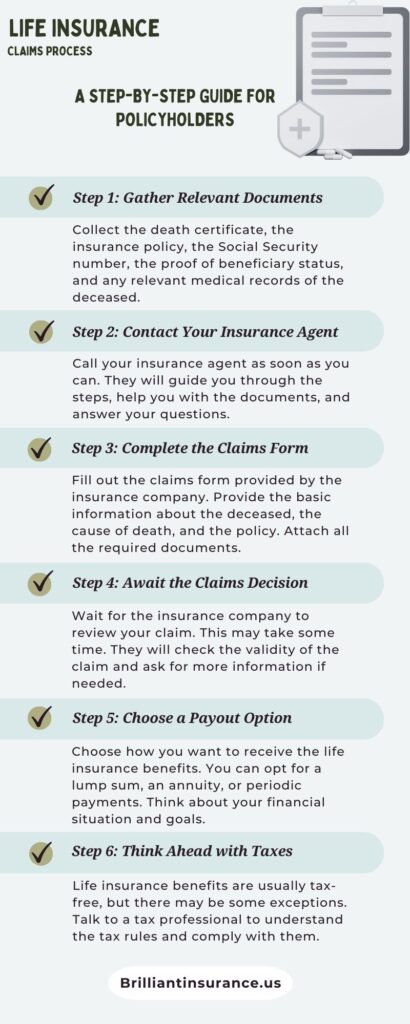

Step 1: Gather Relevant Documents

The first step in the life insurance claims process is to gather all the relevant documents. These typically include the policyholder’s death certificate, the original insurance policy, and any other supporting documentation required by the insurance company. Having these documents in order will streamline the claims process. Below are the essential documents required to start the claim process:

- Death certificate: A certified copy is typically required by the insurance company.

- Life insurance policy documents: Locate the original policy or a copy.

- Social Security number of the deceased: Needed for verification purposes.

- Proof of beneficiary status: This could be the will, trust, or beneficiary designation form.

- Any relevant medical records: If the cause of death is unusual or the policy has specific requirements.

Step 2: Contact Your Insurance Agent

Reach out to your insurance agent as soon as possible after the policyholder’s passing. Your agent can provide guidance on the necessary steps, assist with document collection, and answer any questions you may have about the claims process. Clear communication with your agent is crucial during this time.

Step 3: Complete the Claims Form

Your insurance company will provide a claims form that you need to complete. This form will ask for basic information about the policyholder, the cause of death, and details about the policy. Ensure that you fill out the form accurately and thoroughly, attaching all required documents.

Step 4: Await the Claims Decision

Once you’ve submitted the necessary documents and the claims form, the life insurance company will begin the review process. Please be patient, as it might require some time. During this period, the insurance company will assess the validity of the claim and gather any additional information needed.

Step 5: Choose a Payout Option

Upon approval of the claim, you’ll need to decide on a payout option. Life insurance benefits can be paid out in various ways, such as a lump sum, annuity, or periodic payments. Consider your financial needs and preferences when choosing the payout option that best suits your situation.

Step 6: Think Ahead with Taxes

Life insurance benefits are generally tax-free, but it’s essential to be aware of any potential tax implications. Consult with a tax professional to understand the tax treatment of the life insurance proceeds and to ensure compliance with tax regulations.

What are the Conditions for Claiming Life Insurance?

To claim life insurance benefits, several conditions must be met. These often include:

- Proof of Death: Typically, a death certificate must be submitted to the insurance company.

- Policy Documents: The beneficiary or claimant needs to provide the original insurance policy and

- related documents.

- Claims Form: Most insurers require the completion of a claims form, providing essential details about the insured person and the circumstances of their death.

- Timely Notification: It’s crucial to inform the insurance company promptly after the policyholder’s death. Delays may affect the processing of the claim.

- Cause of Death: The cause of death should align with the policy’s terms and conditions. Some policies may have exclusions for certain circumstances.

Always refer to the specific terms of your life insurance policy, as requirements may vary between insurers and policies.

Conclusion

Navigating the life insurance claims process can be emotionally challenging, but with careful preparation and understanding of the steps involved, you can ensure a smoother experience. By following these steps, you empower yourself to successfully claim life insurance benefits and provide financial support during a difficult time.