When it comes to protecting our health and financial well-being, insurance is a valuable tool. However, the array of insurance options can be overwhelming, especially when it comes to critical illness insurance and health insurance. Both serve important purposes, but they differ significantly in coverage and scope. In this blog, we will explore the differences between critical illness insurance and health insurance, helping you make an informed decision about which one is best for you.

What is Critical Illness Insurance?

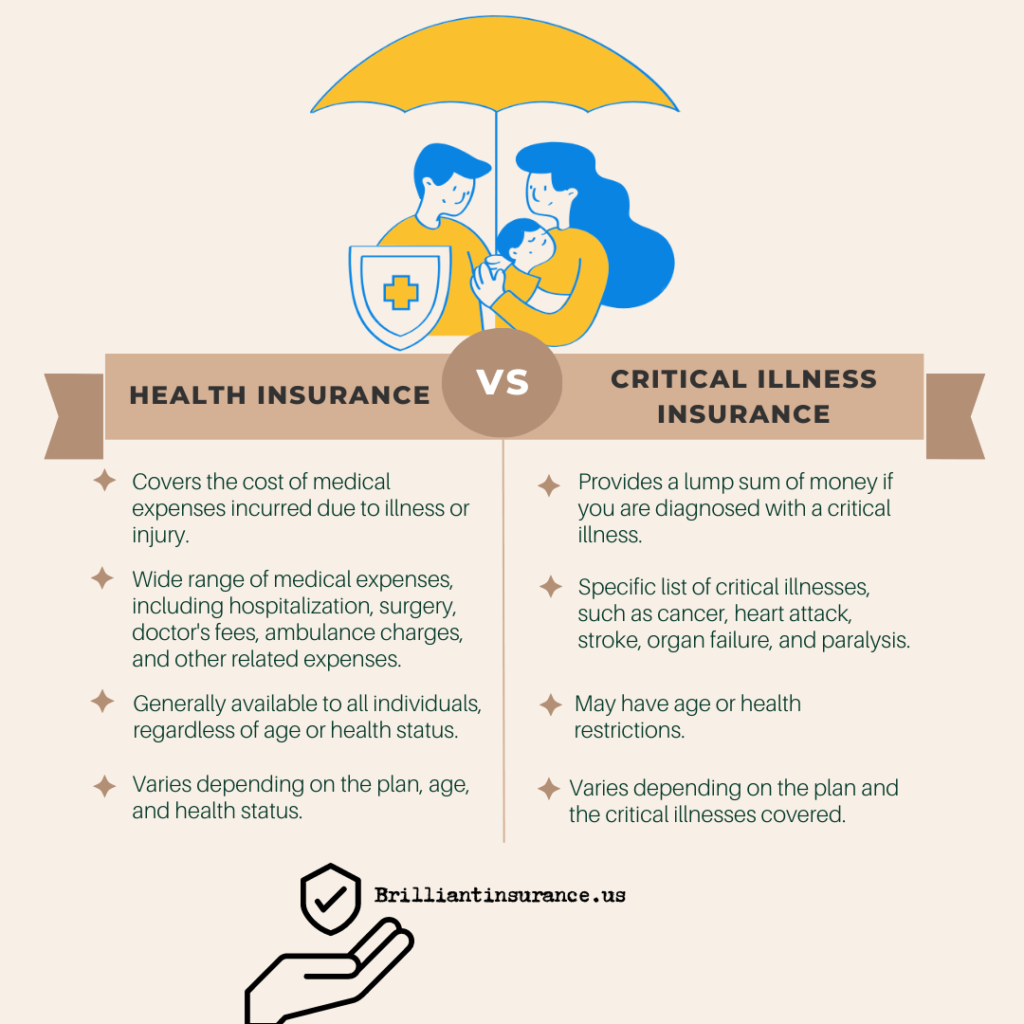

Critical illness insurance can give you peace of mind knowing that you’re financially protected if you’re diagnosed with a serious illness. Unlike health insurance, which typically covers a wide range of medical expenses, critical illness insurance focuses on specific life-threatening illnesses, such as cancer, heart attacks, strokes, and organ transplants, among others. If the policyholder is diagnosed with a covered critical illness, a lump sum payment is made to the insured, which can be used to cover medical treatments, lifestyle adjustments, debt payments, or any other expenses arising from the illness. It offers a layer of financial protection during challenging times, allowing individuals to focus on their recovery without worrying about the burden of medical bills and other costs.

What is Health Insurance?

Health insurance, on the other hand, is comprehensive coverage that pays for various medical expenses incurred due to illness or injury. It includes a wide range of services, such as hospital stays, doctor visits, prescription medications, preventive care, and more. Health insurance policies can be individual, family-based, or provided through employers. Health insurance helps individuals and families manage routine healthcare costs and provides a safety net in the event of unexpected medical needs. It may also include coverage for chronic conditions and long-term medical treatments.

What are the Key Differences between Critical Illness Insurance and Health Insurance?

- Coverage Focus: The primary difference between critical illness insurance and health insurance lies in their coverage focus. Critical illness insurance is narrowly tailored to specific severe illnesses, while health insurance is more comprehensive, encompassing a broader spectrum of medical needs.

- Payment Method: Critical illness insurance pays out a lump sum amount upon diagnosis of a covered condition. In contrast, health insurance typically involves direct payments to healthcare providers, reducing out-of-pocket expenses for the policyholder.

- Utilization of Funds: With critical illness insurance, the lump sum payment can be used at the policyholder’s discretion, covering various expenses beyond medical bills. Health insurance, on the other hand, directly covers medical services and treatments.

Which One is Best for You?

The answer to whether critical illness insurance or health insurance is best for you depends on your unique circumstances, financial situation, and risk tolerance.

Consider Critical Illness Insurance If:

- You have a family history of critical illnesses.

- You are concerned about the financial impact of a severe illness on your savings and lifestyle.

- You seek additional financial protection beyond your health insurance to cover potential treatment-related costs.

Consider Health Insurance If:

- You want comprehensive coverage for a wide range of medical needs, including routine care, doctor visits, and hospitalizations.

- You are more concerned about managing regular healthcare costs than just severe illnesses.

- Your employer provides health insurance as part of your benefits package.

In some cases, a combination of both critical illness insurance and health insurance might be the optimal solution. It’s essential to evaluate your specific needs and consult with insurance experts to determine the most suitable coverage for your circumstances.

Why Do I Need Critical Illness Insurance If I Have Health Insurance?

While health insurance provides valuable coverage for a wide range of medical needs, critical illness insurance serves as a crucial supplement to address specific, life-altering health events. The need for critical illness insurance arises due to the limitations of regular health insurance in certain situations. Health insurance typically covers routine medical expenses, doctor visits, and hospitalizations, but it may not be sufficient to fully protect you and your family in the event of a severe illness like cancer, heart attack, or stroke. Critical illness insurance offers a lump sum payment upon diagnosis of a covered condition, giving you the financial flexibility to address non-medical costs, such as lifestyle adjustments, debt payments, and additional medical treatments. It acts as a safety net during challenging times, allowing you to focus on your recovery without worrying about the financial burden of specialized treatments and expenses not covered by your health insurance policy. By combining critical illness insurance with your health insurance coverage, you create a comprehensive safety net that safeguards your well-being and financial security in the face of life-altering health conditions.

At What Age Should You Get Critical Illness Cover?

The ideal age to get critical illness insurance is typically in your mid-30s to early 40s. At this stage, you are likely to be in good health, and the premiums for critical illness insurance are generally more affordable. By obtaining coverage at a younger age, you can secure protection against potential life-altering health events, ensuring financial security for you and your family in case of a critical illness diagnosis. However, the right age to get critical illness insurance may vary based on individual circumstances, health history, and financial goals. It’s essential to assess your specific needs and consult with insurance experts to determine the most suitable time to invest in critical illness insurance.

What is Considered a Critical Illness for Health Insurance?

Critical illness, in the context of health insurance, refers to a severe medical condition that can significantly impact an individual’s health and quality of life. The specific list of critical illnesses covered by health insurance can vary depending on the insurance policy and provider. However, common critical illnesses typically include cancer, heart attack, stroke, organ transplant, kidney failure, major organ failure, paralysis, and coronary artery bypass surgery, among others. When diagnosed with a covered critical illness, the insured may be entitled to receive comprehensive medical treatment and financial support from the health insurance policy to help manage the associated medical expenses and recovery process.

Conclusion

Critical illness insurance and health insurance serve distinct purposes and cater to different aspects of your well-being. While critical illness insurance provides financial support during a life-altering health crisis, health insurance offers comprehensive coverage for various medical needs. To make an informed decision, assess your health risks, financial capabilities, and existing coverage. Remember to seek guidance from insurance professionals who can help tailor a plan that best fits your individual requirements, ensuring you and your loved ones are adequately protected in the face of any medical challenges that may arise.