What Is Corporate Health Insurance?

Corporate health insurance refers to a health coverage program provided by employers and companies to their workforce.

Essentially, this is a group health insurance policy initiated by the employer and the company, which safeguards both them and their employees. Corporate health insurance plans typically encompass hospitalization, coverage for critical illnesses, maternity benefits, and additional advantages.

In the dynamic landscape of the corporate world, the well-being of employees stands as a cornerstone for sustained business success. Corporate Health Insurance, facilitated by the expertise of a dedicated health insurance agent, far beyond being a mere benefit, emerges as a strategic investment in the vitality of a company.

How Corporate Insurance enhances the well-being of employees and the overall success of a business.

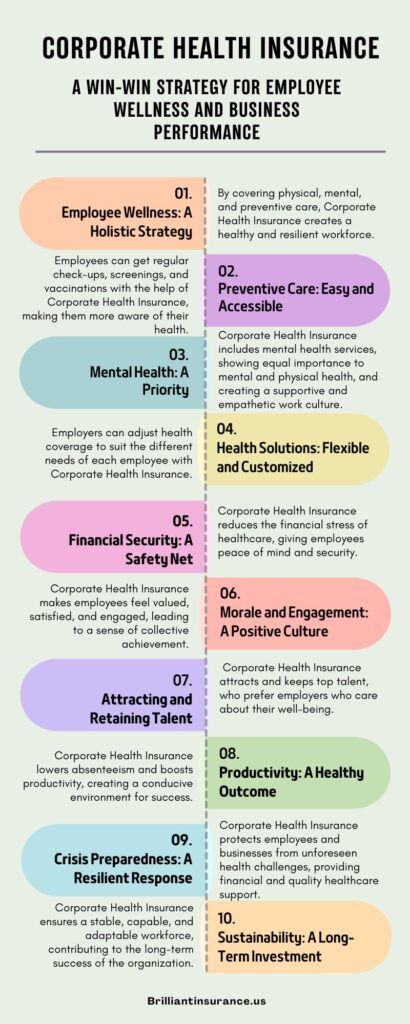

1. A Holistic Approach to Employee Wellness

In the contemporary corporate landscape, the commitment to employee well-being extends beyond traditional benefits. Corporate Health Insurance is a strategic investment that embodies a holistic approach, addressing physical health, mental well-being, and preventive care. This comprehensive wellness strategy is pivotal, forming the bedrock of a thriving and resilient workforce.

2. Accessible Preventive Care

Corporate Health Insurance catalyzes proactive health management by facilitating accessible preventive care. Routine health check-ups, screenings, and vaccinations are no longer distant aspirations; they become integral components of an employee’s wellness journey. The empowerment to take preventive measures elevates health consciousness, fostering a culture of well-being within the organization.

3. Addressing Mental Health Needs

Recognizing the intricate connection between mental health and overall well-being, progressive Corporate Health Insurance plans now integrate mental health services. This proactive stance signifies a paradigm shift, where the workplace culture places equal importance on mental and physical health. Access to counselling, therapy, and mental health resources becomes an intrinsic part of an employee’s health benefits, contributing to a more supportive and empathetic work environment.

4. Customized Health Solutions

Every employee is unique, and Corporate Health Insurance acknowledges this diversity by offering flexibility and customization. Employers can tailor health coverage to meet the specific needs of individual employees. Whether it’s different levels of coverage, specialized services, or unique health considerations, this customization ensures that the wellness strategy aligns with the diverse health needs of the workforce.

5. Financial Security in Health

Beyond the physical and mental aspects, Corporate Health Insurance provides a profound layer of financial security. The safety net it offers reduces the financial burden associated with healthcare. Employees can seek necessary medical attention without the looming fear of exorbitant costs, contributing significantly to their overall peace of mind and security.

6. Boosting Morale and Engagement

A workplace that prioritizes employee well-being through comprehensive health coverage creates a positive culture. Employees feel valued, supported, and recognized as integral contributors to the organization. This positive atmosphere results in higher morale, increased job satisfaction, and heightened engagement with organizational goals, fostering a sense of collective achievement.

7. Attracting and Retaining Talent

In a competitive talent landscape, Corporate Health Insurance becomes a compelling tool for attracting and retaining top talent. Prospective employees are more likely to choose employers who not only offer competitive salaries but also demonstrate a genuine concern for their overall well-being. It becomes a differentiator that sets a company apart as an employer of choice.

8. Enhancing Productivity

The correlation between employee health and productivity is undeniable. Healthy employees are inherently more productive. Corporate Health Insurance plays a vital role in reducing absenteeism due to illness. By ensuring that the workforce remains consistently engaged and healthy, companies create an environment conducive to sustained productivity and success.

9. Crisis Preparedness

Unforeseen health challenges can impact both employees and businesses. Corporate Health Insurance serves as a resilient safety net during such crises. Whether it’s a sudden illness or a more widespread health crisis, the financial support and access to quality healthcare provided by insurance contribute significantly to the resilience and crisis preparedness of both individuals and the organization.

10. Building a Sustainable Workforce

A well-crafted Corporate Health Insurance program is, at its core, an investment in the sustainability of the workforce. Beyond immediate benefits, it ensures a stable, capable, and resilient team that can adapt to challenges and contribute to the long-term success of the organization. The commitment to employee well-being transcends short-term gains, laying the foundation for a sustained and prosperous future.

Conclusion

Corporate Health Insurance, facilitated by the expertise of a dedicated health insurance agent, emerges not only as a shield against health-related uncertainties but as a strategic asset that fuels the success of a business. It goes beyond traditional benefits, becoming a symbol of an employer’s commitment to the overall well-being of its workforce. As companies prioritize the health of their employees, they lay the foundation for a robust and successful business. In the symbiotic relationship between employee well-being and business success, Corporate Health Insurance stands as a catalyst for elevating excellence in the corporate world.