When it comes to safeguarding your family’s financial future, the realms of insurance options can be quite confusing. Among the many choices available, two prominent contenders often stand out: Life Insurance and Accidental Death and Dismemberment (AD&D) Insurance. Both offer protection, but understanding the differences and benefits of each is crucial in making an informed decision. In this blog, we’ll delve into the key differences between Life Insurance and AD&D Insurance, backed by facts and stats to guide you toward the better choice.

Life Insurance: The Foundation of Financial Security

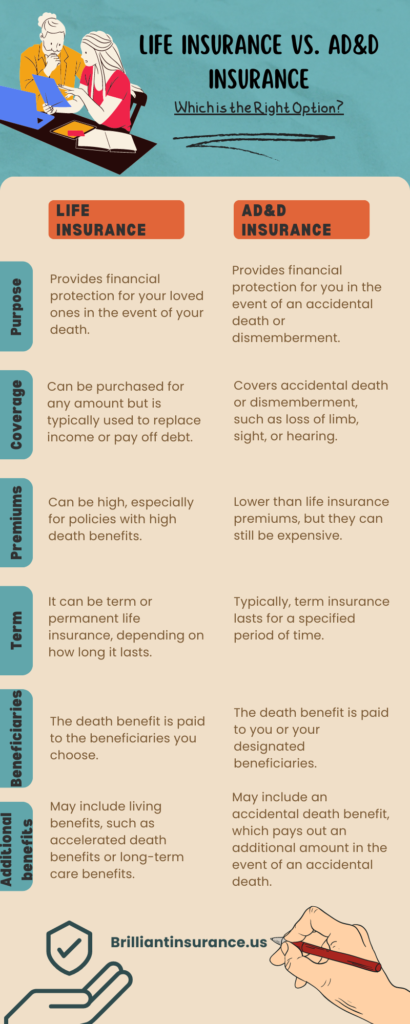

Life Insurance is a time-tested pillar of financial protection that provides a designated sum of money, known as the death benefit, to beneficiaries upon the policyholder’s demise. This coverage extends beyond accidental death, encompassing natural causes and illnesses as well. According to the Insurance Information Institute, 52% of people in the United States have life insurance, highlighting its widespread recognition and importance. This means that about 164 million Americans have some form of life insurance coverage.

Accidental Death and Dismemberment (AD&D) Insurance

Accidental Death and Dismemberment (AD&D) Insurance, on the other hand, focuses specifically on accidental deaths or severe injuries resulting from accidents. It provides a lump-sum payout to beneficiaries in the event of the policyholder’s accidental death or specified dismemberment, such as loss of limb or eyesight. A study by the National Safety Council states that accidents are the third leading cause of death in the United States, underlining the relevance of AD&D coverage.

While both insurance types offer valuable protection, understanding the risks is crucial. According to the Centers for Disease Control and Prevention (CDC), heart disease and cancer are the leading causes of death, accounting for around 27.9% of all deaths in the United States in 2023. This data emphasizes the significance of comprehensive life insurance coverage that extends beyond accidental deaths.

Accidental Death and Dismemberment (AD&D) Insurance Benefits

Life can be unpredictable, and accidents can happen. Accidental Death and Dismemberment (AD&D) insurance offers a financial safety net in case the unexpected occurs. This type of insurance goes beyond traditional life insurance by providing benefits for both accidental death and certain serious injuries.

Here’s how AD&D benefits work:

- Accidental Death Benefit: If the insured dies due to an accident, the policy pays out a lump sum benefit to the beneficiaries named on the policy. This benefit can help cover funeral expenses, outstanding debts, or lost income.

- Dismemberment Benefits: AD&D insurance may also provide benefits for the loss of limbs, eyesight, hearing, or speech due to an accident. The benefit amount typically varies depending on the severity of the injury, with the policy outlining specific coverage details.

Benefits of AD&D Insurance:

- Financial Security: AD&D offers peace of mind by providing a financial cushion for your loved ones in case of a tragic accident.

- Complements Life Insurance: While life insurance covers death from any cause, AD&D focuses specifically on accidental death and serious injuries.

- Relatively Affordable: Compared to other insurance options, AD&D premiums are generally lower due to its focus on specific events.

Comparing Costs and Benefits

Cost considerations play a pivotal role in insurance decisions. AD&D Insurance is often more affordable than traditional Life Insurance due to its limited scope of coverage. However, it’s essential to weigh the benefits against the costs. The American Council of Life Insurers reports that the average funeral cost in the United States is around $7,848 to $9,135, highlighting the potential financial strain on families without comprehensive life insurance coverage.

Do I Need Both Life Insurance and AD&D?

The decision to opt for both life insurance and Accidental Death and Dismemberment (AD&D) coverage depends on your individual circumstances and financial goals. Life insurance offers comprehensive protection, encompassing various causes of death and illnesses, while AD&D insurance specifically covers accidental death and certain injuries resulting from accidents. Evaluating your needs, risk factors, and considering the potential financial impact on your loved ones can guide you in determining whether having both types of coverage is necessary for your peace of mind and their financial security.

Is accidental death and dismemberment (AD&D) Insurance the Same as Life Insurance?

While both AD&D (Accidental Death and Dismemberment) insurance and life insurance provide financial protection, they serve distinct purposes. AD&D insurance specifically covers accidental death and certain injuries resulting from accidents, offering a lump-sum payout to beneficiaries in those scenarios. On the other hand, life insurance offers broader coverage, including various causes of death, illnesses, and natural causes. Therefore, while both insurance types provide valuable safeguards, they cater to different aspects of financial security, and understanding their differences is crucial in making an informed choice that aligns with your needs and priorities.

What is Not Covered by AD&D?

Accidental Death and Dismemberment (AD&D) insurance typically does not cover non-accidental deaths, natural causes, illnesses, suicides, or injuries that are not a direct result of accidents. Moreover, AD&D policies often exclude certain risky activities, such as engaging in acts of war or participating in hazardous sports. It’s essential to carefully review the policy terms and conditions to understand the specific exclusions and limitations of your AD&D coverage, ensuring you have a clear picture of what scenarios may not be covered under this type of insurance.

Does Life Insurance Pay Out for Accidental Death?

Yes, life insurance policies usually provide coverage for accidental death, in addition to deaths caused by illnesses or natural causes. In the event of the policyholder’s death, whether accidental or not, the beneficiaries designated in the policy receive the predetermined death benefit. While life insurance offers comprehensive protection that includes accidental death, it’s important to carefully review the policy terms and conditions to ensure you have a clear understanding of the coverage provided and any specific requirements that need to be met for a successful claim payout.

What Types of Death Does AD&D Cover?

Accidental Death and Dismemberment (AD&D) insurance specifically covers deaths resulting from accidents, such as car crashes, falls, or other unforeseen incidents. In addition to accidental death, AD&D policies may also provide coverage for specified injuries that result in the loss of a limb, eyesight, hearing, or speech due to accidents. It’s important to carefully review the terms and conditions of your AD&D policy to understand the exact scope of coverage and the specific circumstances under which benefits would be paid out to the beneficiaries.

Which is Better Life Insurance or AD&D?

In the Life Insurance vs. AD&D Insurance debate, there’s no definitive winner. The choice ultimately hinges on your unique circumstances, preferences, and financial goals. While AD&D Insurance may provide a more affordable option for accidental death coverage, life insurance offers broader protection that includes accidents, illnesses, and natural causes.

Conclusion

Before deciding, assess your current situation, evaluate potential risks, and consider your family’s needs in the long term. Consulting with an Insurance consultant can provide valuable insights tailored to your individual circumstances, ensuring that you choose the insurance solution that aligns best with your objectives.

Both Life Insurance and AD&D Insurance have their merits, and the better choice depends on your priorities. While AD&D Insurance is specific to accidental deaths, life insurance provides comprehensive protection against a wider range of scenarios. Whichever you choose, making an informed decision will ensure that you provide your loved ones with the financial security they deserve.