What comes to mind when you hear ‘insurance’? Most people think of big giants and popular companies serving different locations worldwide. But there’s another, much easiest and quicker way to buy insurance: working with an insurance agent. Insurance agents can help you save money and offer personal assistance, instead of leaving you waiting on hold with a machine. Unfortunately, there are a lot of misconceptions about working with insurance agents that might prevent you from experiencing the benefits they offer. In this blog, we’ll debunk 7 common myths about insurance agents and discuss their many benefits. So don’t count them out just yet!

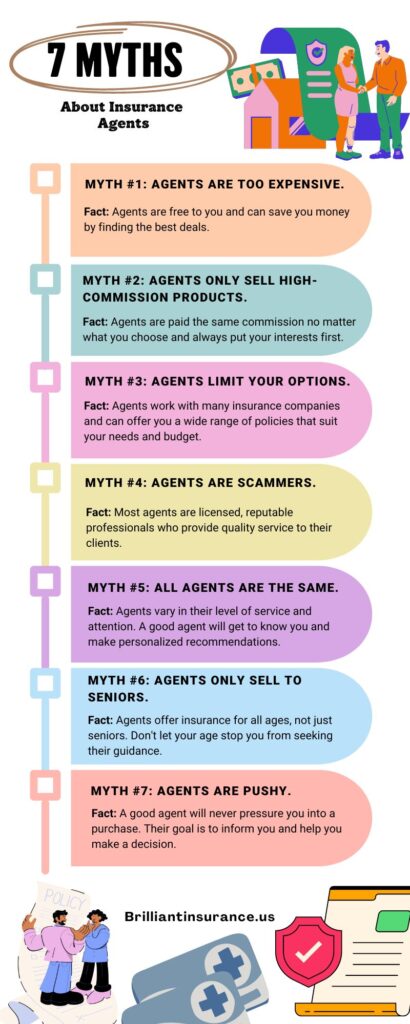

Myth #1: Buying Insurance through an Agent is too Expensive

When you hear the word “agent,” you might immediately think of an advisor who provides recommendations and steers you in the right direction. However, insurance agents are not financial advisors, and their services are generally free to you. In fact, working with an insurance agent can often save you money by finding the best deals on insurance.

Myth #2: Insurance Agents Only Sell You Products with the Highest Commission

While there may be some agents who prioritize their commission over your needs, a good insurance agent will always put your best interests first. Agents are typically paid the same commission no matter which insurance product you choose, meaning there’s no incentive for them to push you toward a more expensive option.

Myth #3: Working with an Insurance Agent Limits Your Options

Insurance agents generally work with a variety of insurance companies, meaning that they can offer you a wider range of options than you might find on your own. They can help you navigate the complexities of insurance and find policies that fit your specific needs and budget.

Myth #4: Insurance Agents are all Scammers

Unfortunately, there have been cases of fraudulent insurance agents who take advantage of unsuspecting customers. However, the vast majority of insurance agents are licensed, reputable professionals who are committed to providing quality service to their clients.

Myth #5: All Insurance Agents are Same, so it Doesn’t Matter Which One I Choose

While insurance agents may sell similar products, the level of service and attention you receive can vary widely. A good insurance agent will take the time to get to know you and your specific situation, making personalized recommendations that fit your needs.

Myth #6: Insurance Agents Only Sell to Seniors

While it’s true that many insurance agents specialize in senior-focused services like Medicare insurance, they also offer other types of insurance that can benefit individuals of all ages. Don’t let your age prevent you from seeking out the guidance of an insurance agent.

Myth #7: All Agents are Pushy – You Shouldn’t Talk to Them Unless You Want to be Forced into Purchasing an Insurance Plan

Pushy agents can be off-putting, but they are not representative of the industry as a whole. A good insurance agent will take the time to understand your needs and concerns and will never force you into a purchase. Their goal is to provide you with the information you need to make an informed decision.

What are the Benefits of Working with a Local Insurance Agent?

Now that we’ve debunked these common misconceptions, let’s explore the advantages of working with an insurance agent.

- They can help you save money by finding the best deals on insurance products.

- They offer personalized assistance, taking the time to understand your unique situation and make recommendations that fit your needs.

- They can help explain confusing insurance terminology, giving you a better understanding of your policy.

- They can provide guidance during the claim process, helping you navigate the complexities of insurance and ensuring that you receive the benefits you’re entitled to.

- They offer peace of mind for you and your family, knowing that you have the right insurance coverage and that you’re protected against unexpected events.

5 Tips for Choosing the Right Insurance Agent

Choosing the right insurance agent is important. Here are a few tips to assist you in making the correct decision:

- Ask for referrals and read reviews from previous customers.

- Assess their communication skills and make sure they’re easy to reach when you need them.

- Make sure they have the proper licenses and certifications to sell insurance in your state.

- Check their experience and expertise in the types of insurance products you’re interested in.

- Review their customer service and make sure they’re committed to providing you with quality service.

Conclusion

Insurance agents can be a trusted ally in navigating the complex world of insurance. Don’t let common myths and misconceptions prevent you from experiencing the peace of mind that comes with having the right insurance coverage. With the right insurance agent, you can save money, receive personalized assistance, and gain a better understanding of your insurance policies.